Royal Sundaram Car Insurance

- P.MATHAI THOMAS v. BRANCH MANAGER,M/S ROYAL SUNDARAM ALLIANCE INSURANCE COMPANY LTD District Consumer Disputes Redressal Commission (12 Aug, 2014) 12 Aug, 2014.

- Original bill along with Satisfaction voucher for cashless claims is required for processing of the claim. For Non-cash-less Claims (Reimbursement claims) Original cash bill or Invoice with Cash receipt is required for processing of the claim.

- Royal Sundaram, one of India’s leading general insurance companies, offers one of the most well-rounded car insurance plans to protect you and your vehicle from any risk of damage. Their policy comes with a host of unique benefits like unlimited liability for third party injury/death claims, personal accident cover for the vehicle owner.

Registered office address: Bharti AXA General Insurance Co. First Floor, Ferns Icon, Survey No. 28, Doddanekundi, Bangalore - 560 037.

Royal Sundaram is a company that is dedicated to providing you with the best there is in terms of Insurance Cover. Our Car Insurance Policy is one that not only helps you protect your vehicle but also cash saving in natureKey Features

Obtain Car Insurance Quote within minutes of filling out the request form on our website.Buy Car Insurance Policy online through our website and have it processed and ready within 24hours. It also includes free vehicle inspection at your doorstep

You can avail the cashless facility across the country along with 24/7 Roadside Assistance in case of emergencies.

In case on the spot repair is not possible, we offer tow service for all leading manufacturers across the country.

A dedicated round the clock helpline for any claim related enquiries

A dedicated personal relationship manager to help you process claims with ease.

The advantage of ensuring your vehicle is serviced/repairs done with no undue delays.

Car Shield

What does Car Shield cover?To understand Car Shield better, let us start with the basics. Car Shield is a protection offered to protect your vehicle from damage caused by another vehicle, including accidents and theft. Not to forget subsequent injuries or damages incurred by third parties.

There are two instances when you can avail Car Shield,

If you are looking to Buy New Car Insurance

If you are going to Renew Existing Car Insurance from any Insurer or Renew your Royal Sundaram Car Insurance Policy

The various aspects covered under this are,

Offers cover for all forms of damage, including theft of car parts and accessories.

Offers third party cover up to Rs. 7.5 lakh applicable only for third party property damage.

Apart from this, if you wish to include other elements, you can choose from the add-on options available. One of the key benefits would be depreciation waiver on metal and plastic parts. This works when you have suffered partial losses apart from having to replace your windshield glass [the Car Shield does not have any impact on the No Claim Bonus]. What is more, in case of a theft or any damage, you are entitled to full coverage on the invoice amount

Buy or renew a new car insurance policy online:

Now that you know about our Car Insurance Policy, here is what you can do to sign up for a new policy or Renew a car insurance policy. All it takes is three simple steps,

Step 1 - Fill out the online Insurance Policy form with the complete vehicle details.

Step 2 - Calculate Premium

Step 3 - Pay online and receive your policy document.

All you need is a reliable Internet connection and payment can be made via Debit/Credit card/ Net banking or through Cheque or Demand Draft.

The Benefits of Buying/ Renewing Car Insurance Policy Online:

With the advancement in technology, things have become so easy that people do not need to step out of their homes or office to complete a transaction. This has extended to the Insurance industry as well. Online Car insurance policies are just like every other service, you read through the information provided, choose the options that fit your requirement, make the payment and complete the process.If you were to sign up with Royal Sundaram Car Insurance Policy, here is what you will receive,

Instant Insurance Policy

Documentation not required in case of online policy process

Live online assistance.

Royal Sundaram Car Insurance

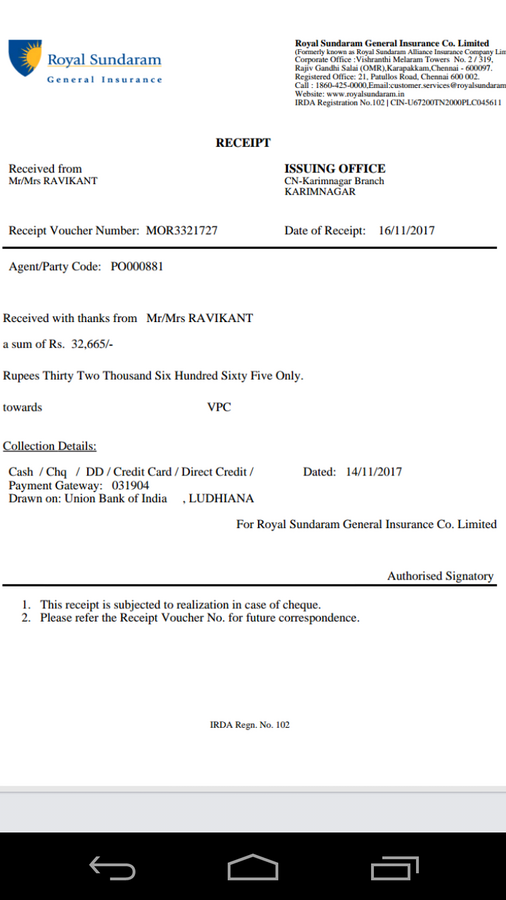

Payment can be made via Debit/Credit card/ Net banking or through Cheque or Demand Draft.Royal Sundaram Motor Satisfaction Voucher

Exclusive Car Model based Discounts on Own Damage Premium

Royal Sundaram Insurance

Wait, there is more. You can also transfer a No Claim Bonus (NCB) from another insurance company when renewing a policy with Royal Sundaram.

Car Insurance Claims Procedure

How to Make a Car Insurance ClaimAs soon as a claim occurs, please call us at 1860 425 0000 or write to us at customer.services@royalsundaram.in, our customer service executive will be happy to help you with the claims procedure.

Royal Sundaram Satisfaction Voucher Download

Process of motor claim.

- Claim Should be intimated to the Insurance company immediately with the policy particulars.

- No repair before survey of the vehicle

- Survey will be arranged on receipt of claim intimation and submission of detailed estimate of repairs from the repairer

- Original Registration Certificate and Driving licence to be submitted to the company for verification and return

- Duly filled in & Signed claim form to be submitted to the Repairer/Surveyor. For company owned vehicles , company seal and authorised person signature should be affixed in the claim form.

- FIR to be filed wherever Third party injury/death/property damage is involved.

- Company may ask for additional documents and /or clarification/Information if any, depending on the requirment of the claim.

- Cashless facility will be arranged if required documents are in order.

- Based on the Surveyors instruction, Vehicle to be produced for re-Inspection on completion of repair works.

- Original bill along with Satisfaction voucher for cashless claims is required for processing of the claim.

- For Non-cash-less Claims (Reimbursement claims) Original cash bill or Invoice with Cash receipt is required for processing of the claim.

- The detailed theft claim process letter will be sent to the Insured's policy/claim form address through Registered Post offer intimation of theft claim.

Royal Sundaram Vehicle Repair Satisfaction Voucher

Below information is required while intimating a claim:

Royal Sundaram Satisfaction Voucher Download

- Your Contact Numbers

- Policy Number

- Name of Insured person

- Date & Time of accident

- Vehicle number

- Make and Model

- Location of Loss

- Brief description on how the accident took place

- Name of Driver

- Place & contact details of the Insured Person if the person intimating the claim is not insured.